The Wall Street Journal

Retailer Cuts Prices After Learning Target's Are Lower

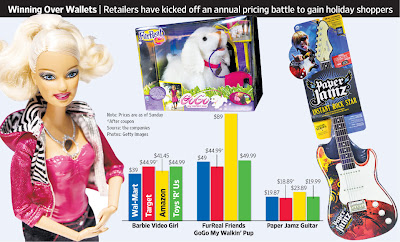

The annual battle for the minds and wallets of toy-buying parents has gotten off to a particularly fierce start, with Wal-Mart Stores Inc. slashing prices in an effort to keep Target Corp. from being the low-cost leader this holiday-shopping season.

Toys are key to many retailers' success at Christmas, because parents will buy stuff for their kids even when the economy is awful. But in recent years shoppers have tended to snap up the biggest toy bargains and ignore stores' other offerings.

This year, with economic conditions somewhat improved, retailers are hopeful that if they can lure parents with a great price on electronic hamsters or Stinky the Garbage Truck, shoppers will make other purchases. But store chains continue to feel the need to stake their low-cost claims just days after Halloween.

"It will still be a very competitive season for toys," said Craig Johnson, president of Customer Growth Partners, a retail and consumer consulting firm. "The reason you are seeing so much early discounting is that retailers are trying to get an early share of the market."

When the biggest retailers came out with their initial holiday toy prices shortly after Halloween, Toys "R" Us Inc. and Amazon.com Inc.—which is touting 25% off hot toys—telegraphed aggressive price cuts.

Amazon's toy prices are for the most part within the range of Wal-Mart, Target and Toys "R" Us, which also offer a variety of free-shipping deals on toys to compete with Amazon. Online toy purchases are rising but still make up a small percentage of all toy sales.

Wal-Mart was offering discounts on a broader selection than the bare-bones list of inexpensive toys it promoted last year. But in many cases its prices were higher than those advertised by archrival Target.

Shortly after The Wall Street Journal asked Wal-Mart last week about its price disadvantage, the company issued a new price list, slashing the sticker on many hot toys.

"This underscores our commitment to offer the lowest prices on top toys," Wal-Mart said in a statement.

With its newly announced prices, Wal-Mart beat Target on many toy prices by just a few pennies. But a few big spreads persist.

For example, Wal-Mart is now selling a Barbie doll embedded with a video camera for $39, or $6 less than Target. Meanwhile, Target has priced Stinky the Garbage Truck—a Matchbox truck that tells jokes—at $49.99, after a coupon, or $6 less than Wal-Mart.

Both retailers say that if a shopper presents them with a print ad featuring a lower price, they will match it.

But Target has a new, potentially potent price weapon that Wal-Mart does not: Shoppers get an extra 5% discount on all purchases, including toys, if they pay with a Target credit or debit card or the Target Visa card.

A much lower proportion of Wal-Mart's customers use credit cards of any sort. Wal-Mart's Discover Card gives buyers 1% back on purchases. As of yet, it has not matched Target's 5% discount.

Casey Carl, vice president of toys and sporting goods at Target, said, "We are doing things differently this year. We're expanding our discounts throughout the season."

Target is putting half of its 2,000 toys on sale this year, an increase of about 10% from 2009. The discounts released last week expire Nov. 24, but will be followed by other sales through the holidays.

"From everything we heard, Target was disappointed with their toy sales last Christmas and they seem to be coming out swinging harder and faster," said Eric Johnson, professor of management at Dartmouth College's Tuck School of Business.

Wal-Mart, meantime, is trying to convey that its toy section, which had shrunk by 30% in recent years, is expanding again, at least during the holidays. It also has more than quadrupled the size of its toy-oriented circular for newspapers, which this year has 52 pages.

In a departure from the last two years, when Wal-Mart emphasized toys for under $10 and $5, the retailer is touting popular toys across a range of prices. The most expensive item on Wal-Mart's top toy list is Big Foot The Monster, which walks, talks and burps, for $84.88.

"We've expanded the selection of toys and widened the array of price rollbacks," said Laura Phillips, Wal-Mart's senior vice president of toys and seasonal merchandise.

Ms. Phillips said that while Wal-Mart's price cuts will last through the season, competitors are expected to raise and lower their prices until Christmas. At rival stores, she said, "customers will have to chase sales."

Dartmouth's Prof. Johnson said he sees a shift in Wal-Mart's strategy. "They don't seem as intent on running everyone out of the toy business," he said.

The holiday selling strategy at Toys "R" Us goes beyond price, said Chief Executive Gerald Storch. The retailer is stocking a wider variety of toys in general and more exclusive toys, where it is not necessary to compete on price. The company, for instance, made a big bet this year on a line of miniature die-cast trains called Chuggington that aren't sold by Wal-Mart, Target or other big chains.

Toys "R" Us also holds events that bring products to customers ahead of the competition, such as Sunday's sale on merchandise involving teen heart throb singer Justin Bieber.

In addition, the retailer offers shoppers who enroll in a loyalty program 10% back on holiday purchases up to $500, via store credit. And the company has created an iPad app where children can create a wish list.

But that doesn't mean Toys "R" Us is ignoring its rivals' prices, Mr. Storch said, adding, "At any time, anyone can have the lowest price on a toy and we respond accordingly."

Toys are key to many retailers' success at Christmas, because parents will buy stuff for their kids even when the economy is awful. But in recent years shoppers have tended to snap up the biggest toy bargains and ignore stores' other offerings.

This year, with economic conditions somewhat improved, retailers are hopeful that if they can lure parents with a great price on electronic hamsters or Stinky the Garbage Truck, shoppers will make other purchases. But store chains continue to feel the need to stake their low-cost claims just days after Halloween.

"It will still be a very competitive season for toys," said Craig Johnson, president of Customer Growth Partners, a retail and consumer consulting firm. "The reason you are seeing so much early discounting is that retailers are trying to get an early share of the market."

When the biggest retailers came out with their initial holiday toy prices shortly after Halloween, Toys "R" Us Inc. and Amazon.com Inc.—which is touting 25% off hot toys—telegraphed aggressive price cuts.

Amazon's toy prices are for the most part within the range of Wal-Mart, Target and Toys "R" Us, which also offer a variety of free-shipping deals on toys to compete with Amazon. Online toy purchases are rising but still make up a small percentage of all toy sales.

Wal-Mart was offering discounts on a broader selection than the bare-bones list of inexpensive toys it promoted last year. But in many cases its prices were higher than those advertised by archrival Target.

Shortly after The Wall Street Journal asked Wal-Mart last week about its price disadvantage, the company issued a new price list, slashing the sticker on many hot toys.

"This underscores our commitment to offer the lowest prices on top toys," Wal-Mart said in a statement.

With its newly announced prices, Wal-Mart beat Target on many toy prices by just a few pennies. But a few big spreads persist.

For example, Wal-Mart is now selling a Barbie doll embedded with a video camera for $39, or $6 less than Target. Meanwhile, Target has priced Stinky the Garbage Truck—a Matchbox truck that tells jokes—at $49.99, after a coupon, or $6 less than Wal-Mart.

Both retailers say that if a shopper presents them with a print ad featuring a lower price, they will match it.

But Target has a new, potentially potent price weapon that Wal-Mart does not: Shoppers get an extra 5% discount on all purchases, including toys, if they pay with a Target credit or debit card or the Target Visa card.

A much lower proportion of Wal-Mart's customers use credit cards of any sort. Wal-Mart's Discover Card gives buyers 1% back on purchases. As of yet, it has not matched Target's 5% discount.

Casey Carl, vice president of toys and sporting goods at Target, said, "We are doing things differently this year. We're expanding our discounts throughout the season."

Target is putting half of its 2,000 toys on sale this year, an increase of about 10% from 2009. The discounts released last week expire Nov. 24, but will be followed by other sales through the holidays.

"From everything we heard, Target was disappointed with their toy sales last Christmas and they seem to be coming out swinging harder and faster," said Eric Johnson, professor of management at Dartmouth College's Tuck School of Business.

Wal-Mart, meantime, is trying to convey that its toy section, which had shrunk by 30% in recent years, is expanding again, at least during the holidays. It also has more than quadrupled the size of its toy-oriented circular for newspapers, which this year has 52 pages.

In a departure from the last two years, when Wal-Mart emphasized toys for under $10 and $5, the retailer is touting popular toys across a range of prices. The most expensive item on Wal-Mart's top toy list is Big Foot The Monster, which walks, talks and burps, for $84.88.

"We've expanded the selection of toys and widened the array of price rollbacks," said Laura Phillips, Wal-Mart's senior vice president of toys and seasonal merchandise.

Ms. Phillips said that while Wal-Mart's price cuts will last through the season, competitors are expected to raise and lower their prices until Christmas. At rival stores, she said, "customers will have to chase sales."

Dartmouth's Prof. Johnson said he sees a shift in Wal-Mart's strategy. "They don't seem as intent on running everyone out of the toy business," he said.

The holiday selling strategy at Toys "R" Us goes beyond price, said Chief Executive Gerald Storch. The retailer is stocking a wider variety of toys in general and more exclusive toys, where it is not necessary to compete on price. The company, for instance, made a big bet this year on a line of miniature die-cast trains called Chuggington that aren't sold by Wal-Mart, Target or other big chains.

Toys "R" Us also holds events that bring products to customers ahead of the competition, such as Sunday's sale on merchandise involving teen heart throb singer Justin Bieber.

In addition, the retailer offers shoppers who enroll in a loyalty program 10% back on holiday purchases up to $500, via store credit. And the company has created an iPad app where children can create a wish list.

But that doesn't mean Toys "R" Us is ignoring its rivals' prices, Mr. Storch said, adding, "At any time, anyone can have the lowest price on a toy and we respond accordingly."