Condé Nast Title, Others Sport Leaner Fall Looks As Marketers Hold Back

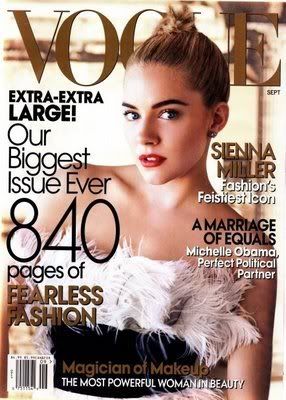

Last year, the all-important September issues of fashion and beauty magazines such as Condé Nast's Vogue and Hearst's Cosmopolitan were thick enough to throw out the backs of mail carriers across the country. The champ, Vogue, weighed in at a hefty 4.9 pounds, thanks to 725 pages of glossy ads.

It is a different story this year. As September issues begin hitting the newsstands, two-thirds of the 16 top fashion and beauty magazines by number of ad pages are smaller than a year ago. W magazine, also published by Condé Nast Publications, a unit of Advance Publications, has 18% fewer advertising pages. Vogue has 674 pages of ads this year, down 7%, while Hearst's Cosmopolitan is six pages, or 3.2%, lighter.

Until recently, fashion and beauty magazines had been something of an oasis amid the steady stream of red ink being reported by print-media properties. Last year was a record year for many titles in the category, and a number of publications were still selling ad pages at that pace into the first quarter of 2008.

The magazines' core marketers in luxury goods, clothing, jewelry and beauty products have been slower than advertisers in other categories to shift spending to the Internet. At the same time, the magazines have a rich history of readers who flip pages as much to see ads for the latest fall fashions as to read the stories, a factor that help keeps advertisers loyal.

But now things are starting to get ugly for the beauty magazines. Ad pages for the top fashion and beauty titles were down about 8% in the second quarter, and publishers acknowledge the downturn largely has held or grown steeper since then.

While luxury advertisers mostly are hanging in, many middle-market clothing and cosmetics firms are paring back ad pages or pulling out completely as a cooling economy quiets their cash registers. Other categories that traditionally advertise in these publications, such as autos and liquor, are also bumpy. At prices that can climb to $120,000 for one full-page ad, every missing page hits the magazines hard.

Of course, the appeal of fashion and beauty magazines' September issues hasn't suddenly vanished. Those pages are still considered a must-buy for many advertisers wanting to pitch new car models, back-to-school shopping and fall fashions. And a number of tony brands are still ubiquitous.

"We have definitely the biggest fall budget we've ever had for advertising," says Alex Bolen, chief executive of Oscar de la Renta. Mr. Bolen says the designer increased its U.S. print media budget by 15% this year, including lavish spreads in the September issues of Hearst's Town & Country; Elle, which is part of Lagardère's Hachette Filipacchi Media U.S.; W; and Vogue. The ads featured items such as a $4,750 Goya handbag.

But in most cases, increased spending by advertisers such as Oscar de la Renta isn't covering the cuts by midtier marketers. Apparel retailer bebe stores took out four pages with In Style -- a magazine published by Time Warner's Time Inc. -- last September and none this September. Nordstrom's had a six-page spread in Elle last year to promote its "via C" clothing line but has nothing this year.

As with other segments of the magazine industry, advertisers are increasingly willing to yank ad spending at the last minute and are less inclined to make commitments far in advance. Most magazine executives aren't optimistic about a turnaround. "Everyone is facing 2009 cautiously," says Valerie Salembier, publisher of Hearst's Harper's Bazaar, which increased its September advertising take by 3%. "I'm nervous, and I think all magazine publishers in our field feel the same way, whether they admit it or not."

By: Shira Ovide

Wall Street Journal; August 11, 2008